how much tax is taken out of my paycheck indiana

Where Do Americans Get Their Financial Advice. Filing 6000000 of earnings will result in 618750 of that amount being taxed as federal tax.

My Job Is Taking 20 Of My Paycheck To Federal Taxes I M A Minor 14 Is That Too High Quora

You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202122.

. How much in taxes will be taken out of your 70000 paycheck in New York City. Up to 25 cash back If you arent supporting a spouse or child up to 60 of your earnings may be taken. The Social Security tax rate is 620 total including employer contribution.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Switch to Indiana salary calculator. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki. Late filed returns are subject to a penalty of up to 20 and a minimum penalty of 5. Amount taken out of an average biweekly paycheck.

Use tab to go to the next focusable element. A 2020 or later W4 is required for all new employees. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the.

Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Indiana tax year starts from July 01 the year before to June 30 the current year. However they dont include all taxes related to payroll. You Should Never Say I Cant Afford That.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Therefore FICA can range between 153 and 162.

FICA taxes consist of Social Security and Medicare taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator.

Indiana Salary Tax Calculator for the Tax Year 202122. Indiana state income taxes are pretty straightforward. Indiana Hourly Paycheck Calculator.

An additional 5 may be taken if youre more than 12 weeks in arrears. Get ready today to. So the tax year 2021 will start from July 01 2020 to June 30 2021.

1240 up to an annual maximum of 147000 for 2022 142800 for 2021. For a single filer the first 9875 you earn is taxed at 10. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State Income Tax Rates and Thresholds in 2022. For more information about or to do calculations involving Social Security please visit the Social Security Calculator. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

- Indiana State Tax. FICA taxes are commonly called the payroll tax. Your average tax rate is 222 and your marginal tax rate is 361.

Indiana Hourly Paycheck and Payroll Calculator. Our calculator has been specially developed in order. Need help calculating paychecks.

Information Bulletin 119 Internal Revenue Code Provisions Not Followed by Indiana and Clarification of Related Issues has been updated to reflect several changes enacted by the American Rescue Plan ActAlso this bulletin has been updated to provide for. Details of the personal income tax rates used in the 2022 Indiana State Calculator are published below the calculator. Rates do increase however based on geography.

Additional local income tax for each county 035 to 338 no state-level payroll tax. If you previously registered to file withholding tax you must still file Forms WH-1 and WH-3 for each period even if no tax is due or to report no employees for that time period. Able to claim exemptions.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. Switch to Indiana hourly calculator. Unlike the federal income tax system rates do not vary based on income level.

IR-2019-178 Get Ready for Taxes. That 14 is called your effective tax rate. Indiana Salary Paycheck Calculator.

Find out more about conformity to the IRC and Indianas tax treatment of federal COVID-19 provisions. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana.

Its a flat tax rate of 323 that every employee pays. But on top of state income taxes each. Social Security has a wage base limit which for 2022 is 147000.

For employees earning more than 200000 the Medicare tax rate goes up by an additional 09. - FICA Social Security and Medicare. The income tax is a flat rate of 323.

Indiana has the same limits as federal law on what can be taken from your paycheck for this type of wage garnishment. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Your employer will be able to give you the total percentage amount that will be withheld form your 70000 paycheck in NYC.

These amounts are paid by both employees and employers. 124 to cover Social Security and 29 to cover Medicare. This 153 federal tax is made up of two parts.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Filing 6000000 of earnings will result in 459000 being taxed for FICA purposes. Only the very last 1475 you earned would be taxed at. After entering it into the calculator it will perform the following calculations.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Thats the deal only for federal. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Pay Stub Requirements By State Overview Chart Infographic

Paycheck Calculator Take Home Pay Calculator

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

I Make 800 A Week How Much Will That Be After Taxes Quora

Indiana Paycheck Calculator Smartasset

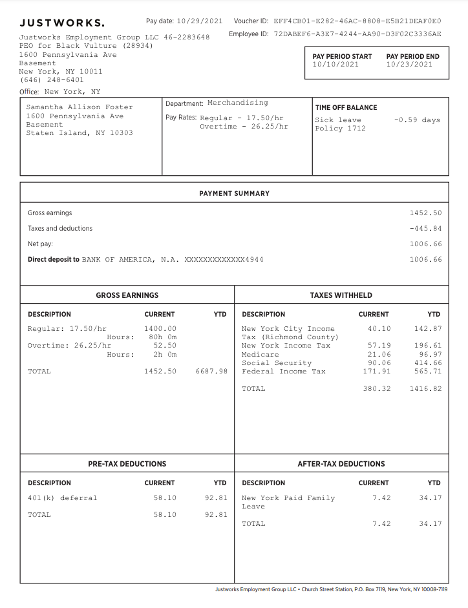

Questions About My Paycheck Justworks Help Center

Indiana Paycheck Calculator Updated For 2022

Indiana Income Tax Calculator Smartasset

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Tax Withholding For Pensions And Social Security Sensible Money

Understanding Your Paycheck Credit Com

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

State Of Indiana Frequently Asked Questions Faqs

Indiana Taxes For New Employees Asap Payroll Services

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New W 4 Irs Tax Form How It Affects You Mybanktracker